Fed Economist Arrested: Espionage Allegations for Beijing Shake U.S. Financial World

Fed economist accused of espionage for Beijing, allegedly leaking U.S. financial secrets to China. Read the full chronology and impact here.

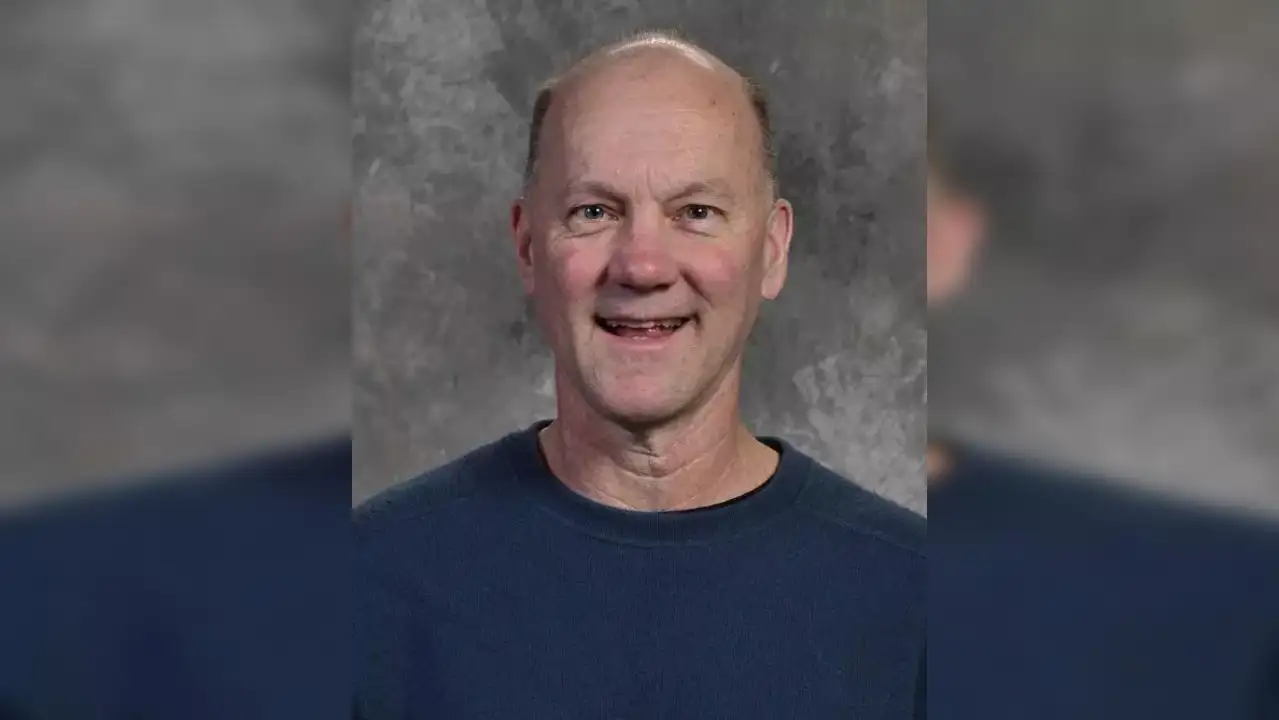

The United States has been rocked by yet another major scandal. John Harold Rogers, a senior economist at the Federal Reserve (The Fed), has been formally indicted on economic espionage charges after allegedly leaking confidential information to Chinese intelligence agents. This case has immediately raised concerns about U.S. financial data security and highlights the threat of foreign infiltration into America’s most vital institutions.

Chronology of John Rogers’ Arrest

John Rogers’ arrest comes amid rising tensions between Washington and Beijing over espionage and global economic competition. Rogers, who served in the Fed’s International Finance Division from 2010 to 2021, is accused of initiating contact with Chinese intelligence agents as early as May 2013 during a visit to Shanghai. At that time, he accepted an all-expenses-paid invitation to China.

According to the U.S. Department of Justice, Rogers did not merely meet with these individuals; he also leaked a series of internal Federal Reserve reports, including sensitive documents prepared for the Federal Open Market Committee (FOMC). This information is extremely valuable, as it could be used to predict U.S. economic policy changes before they become public, offering enormous advantages to certain parties.

Alleged Transactions and FBI Findings

Further investigation revealed that Rogers reportedly received up to $450,000 in 2023, officially as a part-time professor at a Chinese university. During a search of his Washington, D.C. apartment, the FBI found $50,000 in cash. While his wife claimed the cash was hers, this discovery has only fueled suspicions against Rogers.

Authorities assert that Rogers’ actions potentially allowed China to manipulate American financial markets, in a manner akin to insider trading with high economic stakes.

Rogers’ Defense and China’s Response

John Rogers insists that all his communications were legitimate academic collaborations. He vehemently denies ever intentionally aiding the Chinese side. His legal team claims that the indictment ignores the real context of international academic relationships and intends to contest the charges in court.

Meanwhile, the Chinese government has rejected all allegations. A spokesperson for China’s Ministry of Foreign Affairs stated that the country upholds the rule of law and opposes all forms of espionage. This response underscores Beijing’s defensive stance in the face of growing Western accusations.

Threat of Infiltration and Global Impact

The Rogers case serves as a stark reminder of the real danger posed by sophisticated Chinese intelligence operations. Western analysts believe that China has become increasingly aggressive in penetrating foreign economic and governmental institutions, from universities to central banks. This scandal further amplifies fears over strategic data leaks that could destabilize global markets and affect U.S. monetary policy.

Security experts say Rogers’ arrest proves just how weak internal controls can be at crucial institutions like the Fed. Many are calling for the U.S. to strengthen early warning systems and tighten access to sensitive documents to prevent future incidents.

A Warning Sign for the Financial System

The John Rogers case is a bitter lesson for the Federal Reserve and the global financial community. Economic and political competition between the U.S. and China is heating up, now spilling over into national security concerns. The world now waits to see how U.S. courts will process this case and what its long-term impact will be on public trust in the American financial system.

Comments ()